Revolving credit cards: How do I pay back the credit?

06/11/2020

As we have explained in previous posts, revolving credit cards often provide flexibility when it comes to choosing the instalment you wish to pay. This makes it easier for customers, who frequently find it more convenient to opt for small monthly payments. However, you need to be aware of the implications of the instalment you choose.

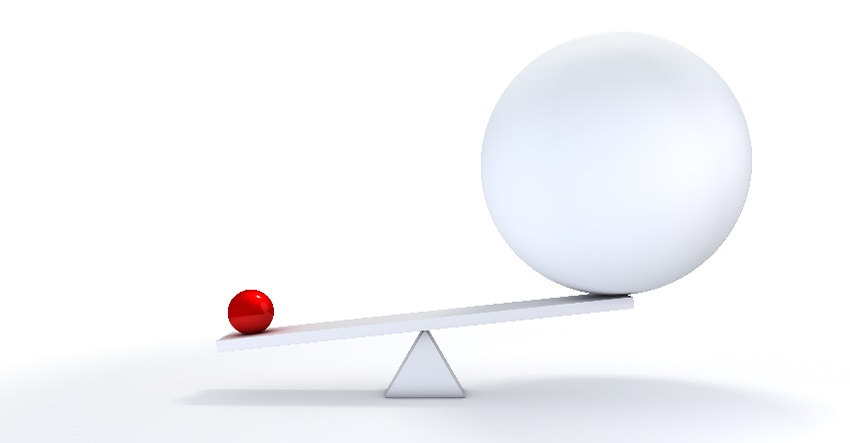

Use our calculator to find out how long it will take you to repay your debt with the chosen instalment, and the interest you will be charged. Bear in mind that a very low monthly instalment will only cover the interest, other possible charges and a very small portion of the capital borrowed. The smaller the instalment, the longer it will take you to pay off your debt and the more interest you will be charged. In addition, you run the risk of getting yourself into permanent debt and having to cover ongoing interest charges without paying back any capital. Taken to extremes, if the instalment is so small that it only covers interest and other charges but no capital, you will become permanently indebted, making monthly payments but always owing the same amount.

Consider carefully the alleged benefits (discounts, refunds, promotional gifts, etc.) offered for deferring your card payments and compare them with the interest you may be charged. For example, if you were to spread the cost of purchases amounting to €600 over 40 months, with a monthly instalment of €20 and interest of 20%, and the bank refunded 5% of those purchases, you would be paying interest totalling €209.6 over that period, whereas the refund would only amount to €30.

And bear in mind that when the bank offers you a “free” card, it usually means that it will not charge you a fee for the card itself or for using it, but that is not to say that it will not charge you interest on the associated credit to defer your purchases.

Lastly, remember that deferring payments on a revolving credit card involves activating credit, so it is important that you:

- Explore all the different payment options available to you.

- Calculate the maximum instalment you can assume so as to pay as little interest as possible.

- Compare with other financing options offered by your bank, or with the same product offered at other banks.