When you go shopping, have you ever thought about how much it costs you to defer payment?

21/01/2019

Loan or card? Before asking for financing, calculate how much the repayments will cost you.

Do you know that the cost will differ depending on whether you opt to use the credit associated with your card or you take out a consumer loan intended for that purpose?

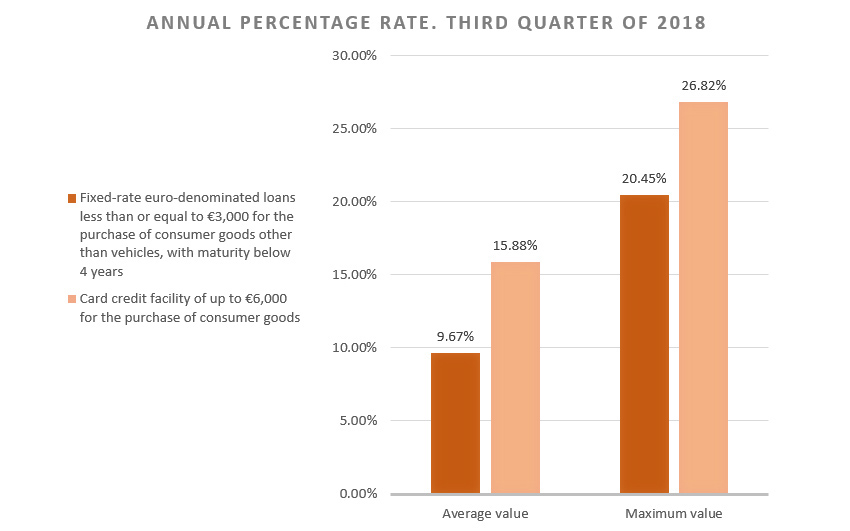

We show you below the average APR applied most frequently in the third quarter of 2018, for fixed-rate euro-denominated loans below €3,000 with maturity under 4 years and the APR applied when you use the credit associated with your credit card in transactions below €6,000 euros, assuming in both cases that consumer goods are being purchased.

This information is drawn from credit institutions’ individual reports to the Banco de España and can be found at Información pública trimestralAbre en ventana nueva.

If you are thinking of using a revolving card, we recommend you use our simulatorAbre en ventana nueva to obtain information on how to repay the debt.