Are Spaniards less financially knowledgeable than the rest of the world?

16/10/2018

In recent months we have been picking through the main results of the ECF (Survey of Financial CompetencesAbre en ventana nueva), jointly conducted by the Banco de España and the CNMV using a representative sample of adults (aged 18-79) in Spain, to ascertain the Spanish population’s degree of financial literacy and their most common habits and decisions in financial matters. It has helped us form a picture of the national landscape in terms of financial knowledge, but where do we stand in relation to other countries? Where is Spain positioned if we make an international comparison? We dedicate this latest post on the ECF to this issue.

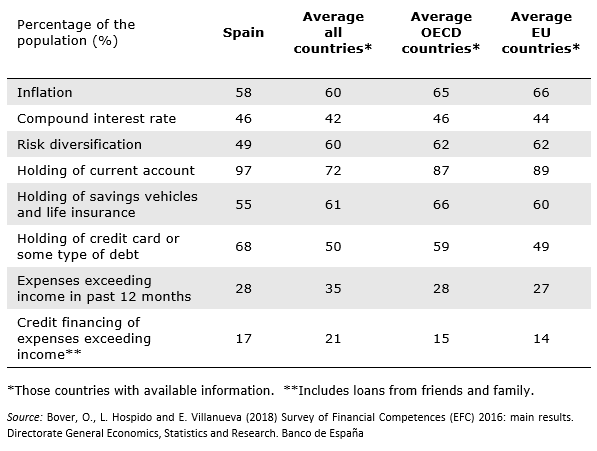

The ECF includes questions from an international study by the OECD that measured financial literacy. This means the replies obtained in Spain can be compared with those of peer countries, specifically with OECD and EU members. The following emerges:

-

As regards financial literacy, the level of the Spanish adult population stands around the average for the countries considered. In any event, the average for correct replies in the group of countries in question ranges between 40% for knowledge of compound interest and 60% for inflation, suggesting that a large portion of the population in those countries is not familiar with basic financial concepts. In the case of the “risk diversification” concept, Spaniards lie clearly below the average.

-

As to the holding of financial products, Spaniards:

-

Stand above the average for all the countries considers when it comes to holding a current account.

-

We lie below in the holdings of savings vehicles (savings accounts, pension schemes, investment funds, shares, fixed income and life insurance).

-

We exceed the average of all the countries considered in the holding of debt (credit cards, mortgage and personal loans).

-

It should be clarified, however, that the list of financial products presented to survey respondents may have varied from country to country, except for current accounts.

-

- Finally, if we look at “dissaving” decisions, the percentage of individuals whose expenses exceeded their income over the past year is similar to the average for the OECD and EU countries. However, it should be borne in mind that, in Spain, the ECF asked about “household” rather than “individual” expenses and revenue; the international study asked about the latter.