Acquiring financial products: do we compare alternatives first?

What are our decisions based on when acquiring financial products? Do we consider different alternatives first? From a single company or from several? What sources of information influence our decision?

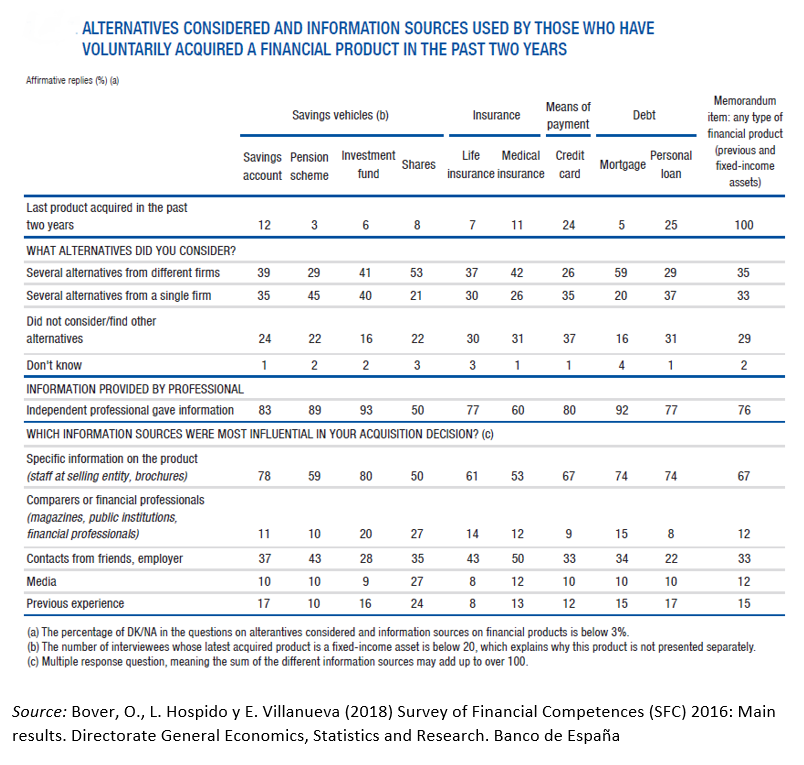

The recent Survey of Financial Competences (SFC)Abre en ventana nueva, addressed to a representative sample of adult citizens in Spain (aged 18-79) and conducted jointly by the Banco de España and the CNMV (National Securities Market Commission), analyses these questions and finds that only 35% of Spaniards who have acquired a financial product in the past two years considered alternatives from several institutions (62% confined themselves to those offered by a single company or did not consider or find any other option).

The survey also shows different results according to the financial product in question. For instance, in the case of individuals who purchased shares or took out a mortgage, slightly over half considered alternatives from several institutions (53% and 59%, respectively), while this figures stands at around 26-29% for those who have taken out credit cards, personal loans and pension schemes. To correctly understand these percentages, it should be borne in mind that those who have acquired shares have higher of income and educational levels than those who have taken out personal loans in the past two years.

As regards the information sources used, among others, when acquiring a financial product:

- Of most particular note is the specific information on the product provided by the staff of the company offering the product or through brochures (a source used by 67% of those who have acquired a financial product in the last two years).

- Following this is the information from contacts with friends or family, one of the most influential sources when acquiring a new product in 33% of all cases.

- Previous experience bears an influence in 15% of cases.

- Both the use of product comparers and the information in the media also bear an influence when acquiring new financial products for 12% of the population who have acquired any type of financial product.