What financial products are most frequently taken out by Spaniards?

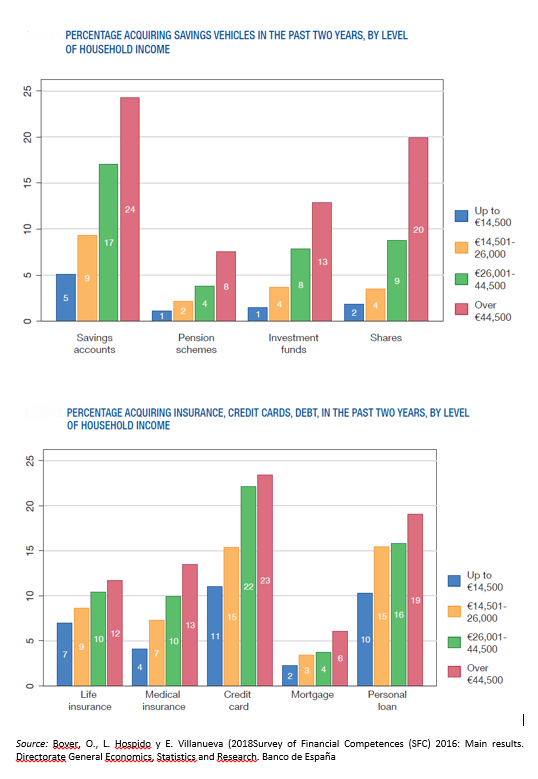

According to the Survey of Financial Competences, performed jointly to a representative sample of adult citizens in Spain (between ages 18 and 79), by Banco de España and the National Securities Market Commission (CNMV), the financial products most frequently taken out are credit cards, personal loans and savings accounts (16%, 14% and 11% of the population have respectively taken out one of these products in the past two years).

They are followed by insurance products, both life insurances (9%), as well as medical insurances (8%). Lagging behind are shares and investment funds (6% and 5% respectively), as well as fixed income products (1%). 3% of the interviewees have taken out pension plans and another 3% took out mortgage loans, even though these are products that aren’t frequently taken out in a lifetime.

Another result highlighted by the report’s authors is that the rate of individuals that take out financial products increases with the educational level, and especially with the household income:

- The household income is a particularly sensitive factor when it comes to shares and investment funds. 2% of the interviewees with a household income under 14.500 Euros acquired shares, and 1% took out an investment fund. In comparison, these rates are higher when the household income is over 44.500 Euros (20% and 13% respectively).

- However, differences aren’t as noticeable when it comes to purchasing debt (mortgage or personal loans), or when taking out insurances or credit cards.

By age groups, individuals over 64 are those who take out less financial products: only 25% said they had taken out a financial product in the past two years. This would be 22% less than the result for individuals between 35 and 44.