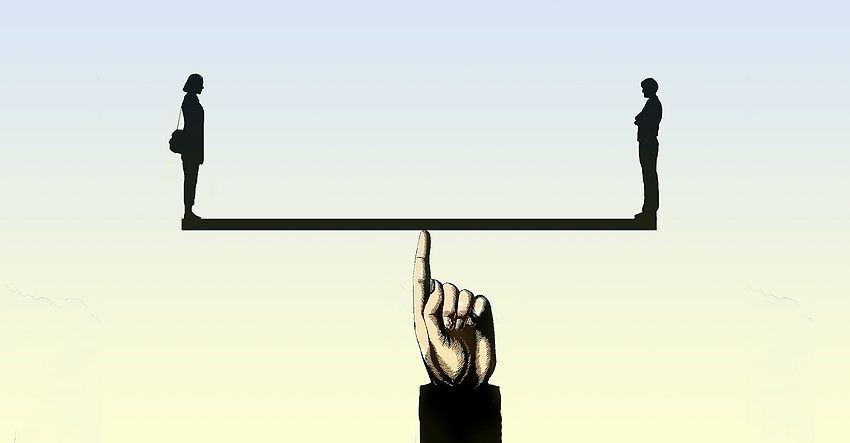

The gender gap in bank credit access

11/02/2020

The Banco de España’s tasks Abre en ventana nuevainclude producing studies and research on the financial and economic situation.

Access to credit is of crucial importance for the setting up and survival of small companies and, ultimately, for the economy. The Banco de España has recently published a study in which it analyses the existence of possible gender bias in access to credit. “The gender gap in bank credit access”Abre en ventana nueva.

The study analyses CCR data on loans applied for and granted to more than 80,000 firms set up by a sole proprietor, over a decade. It was found that:

- Female entrepreneurs apply for fewer loans when starting a business.

- Women are less likely than men to obtain financing in the founding year of their business. These differences disappear after the first year, once the bank is able to obtain accounting information about the company itself and does not base its decisions exclusively on the personal characteristics of the entrepreneur.

- Women-led companies are less likely to default in the founding year. However, as with access to credit, after the first year, no gender differences are observed.

Therefore, the fact that such differences are only observed in the early years of a company’s life, when there is less objective information available for determining the viability of the business, may point to the possible presence of unconscious double standards, that is, implicit discrimination.

Most importantly, the study suggests that such bias can easily be corrected if the existence of the situation is acknowledged and loan approval systems are reviewed to counter such unconscious bias.