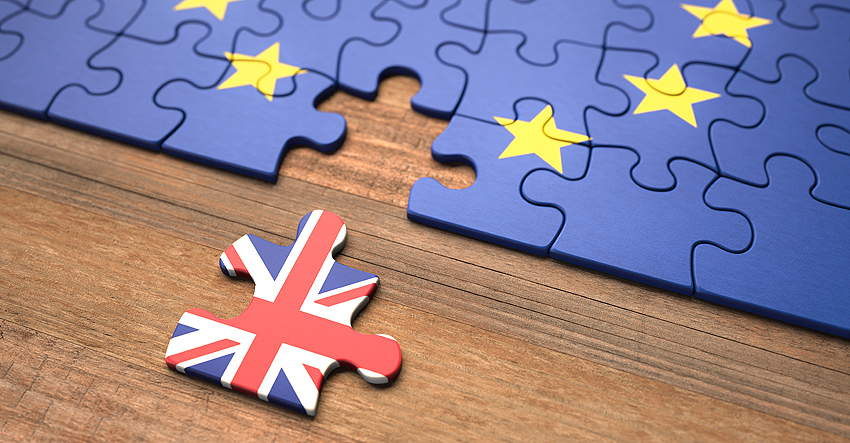

Brexit: how does it affect you if you are a customer of a British bank?

As you may know, EU law has ceased to apply in the United Kingdom, following its exit from the European Union, since 1 January. What happens from then on? If you are a customer of a British bank, you might find this article useful. Here is a summary of the most important takeaways:

- British banks wishing to continue to provide their services in the EU must request authorisation to carry out their activities. Those who stop providing services in the EU shall do so at no cost to their customers. In practice, many have applied for a banking licence in one of the EU countries.

- Bank transfers to and from the United Kingdom must include more information. The current account number will no longer suffice: you will have to provide the payer’s name, address, ID card number or date of birth.

- Contact your bank to find out about its deposit guarantee scheme. UK rules may differ from EU rules.

- Banks must duly inform their customers whether they will continue to provide their services and, if not, what consequences this may entail.

The European Banking Authority has published a briefing noteAbre en ventana nueva of which we have outlined the main points. Do not hesitate to check it out for more details.