If the traffic light is red, the product is not for you

26/06/2025

You may have already seen this box, either in the advertising of financial products or in the documentation that your entity has given you when you have been interested in one.

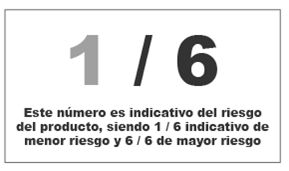

This table belongs to the financial products risk classification system, a system designed to enable customers to easily understand the level of risk of financial products that institutions can offer them. The information is presented in a homogeneous, visual and comprehensible way.

The initiative aims for consumers to make their financial decisions with the maximum information. This classification affects only some products, including bank deposits (on demand, savings and term deposits, among others).

The system is simple and in a common format for all products. It divides products into six classes, in ascending order from lowest to highest risk. From Class 1 for very low risk (e.g. overnight or term euro deposits) to Class 6 for very high risk (e.g. complex or highly volatile products).

But in addition to alerting the risk, and so that customers can weigh whether the product offered to them is adapted to their needs, the standard also requires entities to report on the following aspects:

- Product Complexity: if you require advanced financial knowledge for your understanding. The sentence should read as follows: Financial product that is not simple and can be difficult to understand

- The degree of liquidity, that is, whether it is possible to recover the money at any time or if there is a term or conditions for it.

- Possibility of total or partial loss of capital, since there are products in which the recovery of the total amount of the contribution is not guaranteed.

- Costs associated with early repayment (fees, penalties, etc.), as well as minimum notice periods to request it.

It is important to look at these alerts because they give us relevant information to make the right decision. This practice also makes it possible to compare products from different entities and prevent unpleasant surprises about hidden risks or unexpected costs.

This system not only protects the consumer but should also foster trust in the financial system by promoting transparency and accountability.

“Disclaimer: Please note that this is a translation of the original in Spanish that has been obtained using eTranslation (the machine translation tool provided by the European Commission), with the intention of giving you a basic idea of the content in English until a human translation becomes available. The Banco de España accepts no liability whatsoever in connection with this translation.”