Recommendations to follow when a merchant offers you financing

27/05/2021

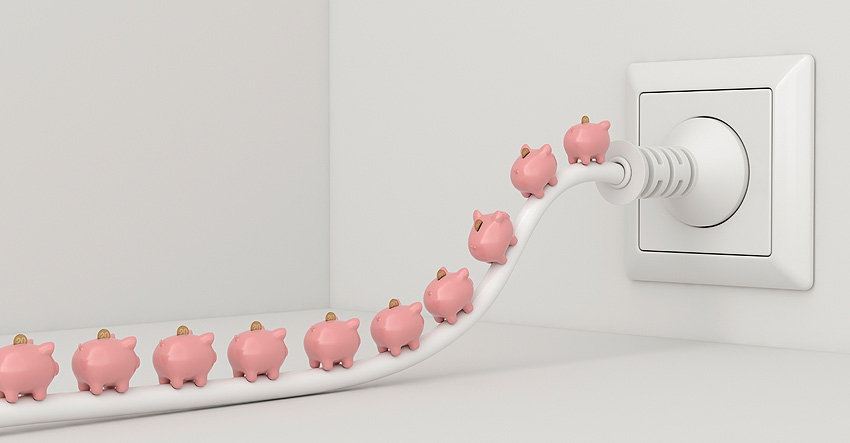

Not having enough funds to buy a car or a computer, to travel, to study a master’s degree or to undergo medical treatment doesn’t mean you have to go without. In such cases, financing is an option.

Universities, retailers, car dealerships and clinics often partner with financial institutions to offer financing for their own products and services.

Financing can therefore offer an opportunity, but caution is required. Before agreeing to such financing, ask yourself how long you’ve spent choosing the car and how long you’ve spent studying the terms of the financing. Consider beforehand whether your income will cover your debt repayments, how long it will take you to pay it off and how much it will cost.

Although the offer and the formalities are processed at the point-of-sale, the financing is actually extended by the associated financial institution, which will sign a consumer credit agreement with you that links the purchase of the good or service to the approval of the loan. Find out exactly what kind of institution it is and make sure you have its contact details.

As with any other loan, before approving the credit, the institution must fulfil the same obligations as if it were extending the loan directly. These include assessing your credit status, giving you a full explanation of the type of operation, and providing you with pre-contractual information (European Standardised Information Sheet). Don’t forget that you still have the right to withdraw from the agreement.

Another way to provide financing through partners is via credit cards, which are frequently offered by shopping centres and large retail outlets as a means of paying for shopping.

In such cases you will often be asked at the checkout (either in store or on the website) how you want to pay. Care must be taken at this point, particularly with revolving credit, which often charges very high interest, meaning it will take a long time to pay off. See for yourself using our simulator.