From the euro to the pandemic: the use of payment methods and online banking in Spanish households

20/04/2023

On 1 January 2002, ATMs started dispensing European currency for the first time and Spaniards were trying to understand how many pesetas were in a euro, they were angry at rounding up, calculating new prices... From then until 2020, the year of the pandemic, a lot changed. Our personal finances were no exception.

The Banco de España has recently published a document on the use of payment methods and online banking in Spanish households, based on data provided by the Survey of Household Finances between the years 2002-2020. The study analyses how the behaviour of Spanish households has changed in terms of the use of bank cards and online banking.

These are some of his most interesting conclusions, referring to the general population, without distinguishing between rural and urban areas.

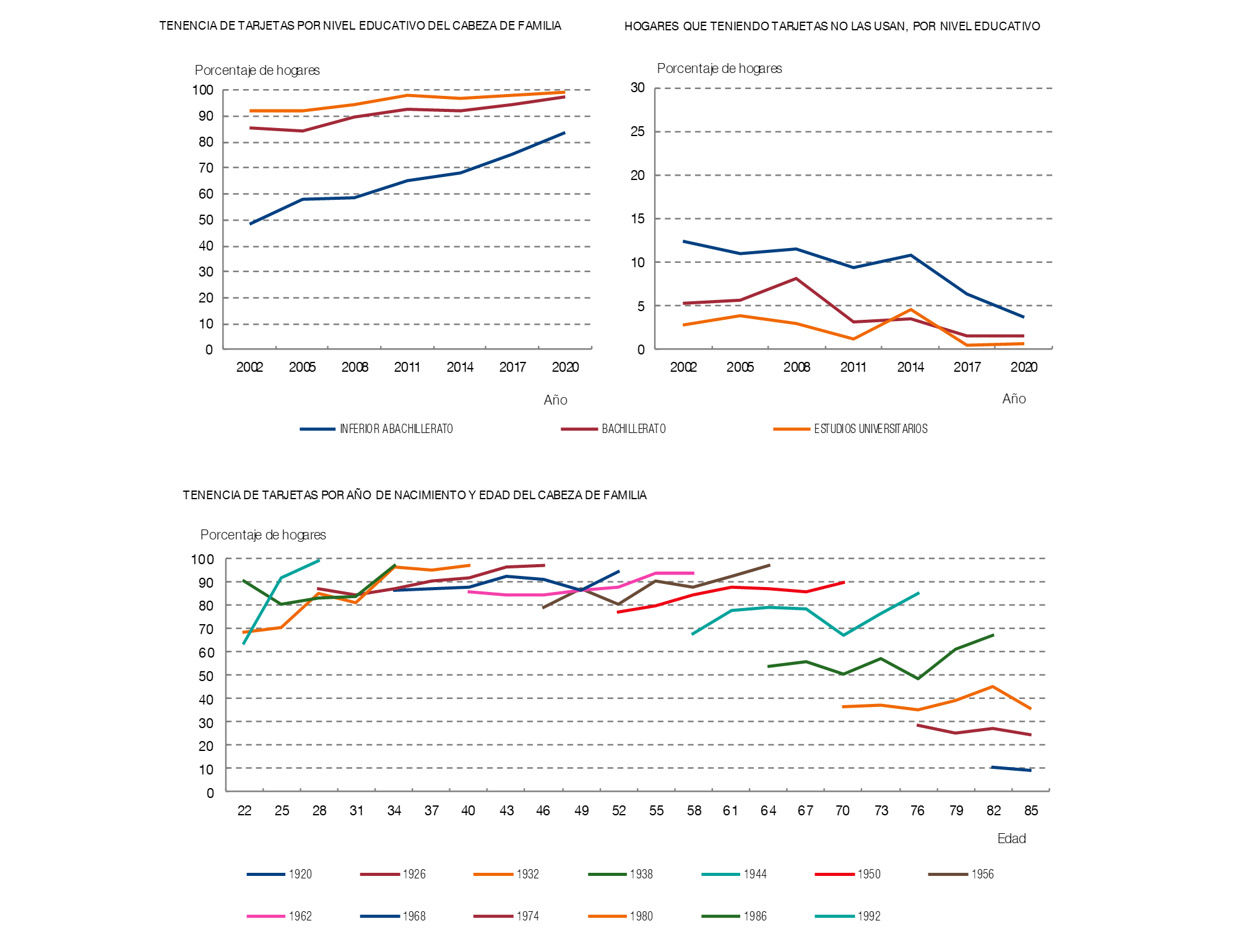

- First, the popularity of bank cards, the use of which has spread and has especially grown in households with lower levels of education and income. Nevertheless, even in 2020, 20% of these households either did not have a card or, even if they did, they did not use it for purchases or to withdraw money from ATMs (around 1,760,000 families). In addition, 33% of households whose heads of household were born around 1940, (in their 80s) did not have this means of payment either.

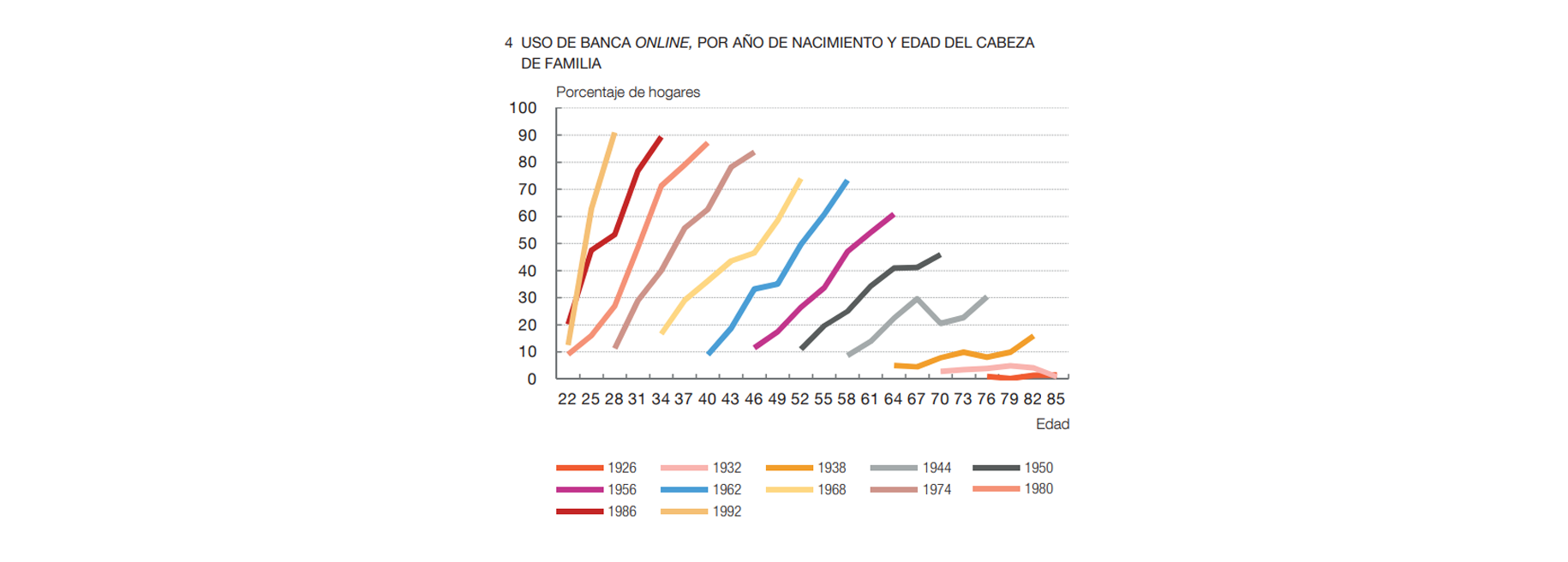

- Second, there has been an increase in the use of online banking in households of all types between 2002 and 2020. Half of all respondents engage with their bank digitally, at least occasionally, even among people with an educational level lower than upper-level secondary education. However, there are significant differences by age. For example, just over 80% of households in which the head of the household was born before 1944 do not use online banking (around 2,130,000 households).

- Finally, it should be noted that, despite the advances made in recent years, there are still certain groups that, probably due to a lack of digital skills, are not yet able to regularly use bank cards or online banking. And that advances in the digitalisation of financial services could leave these groups particularly exposed to the risks of financial exclusion.

For more information, you can consult the occasional document “Heterogeneity in the use of payment methods and online banking: an analysis based on the Spanish Survey of Household Finances (2002-2020)” on the Banco de España website at the following link: