What's behind a card payment?

10/06/2025

When you use your card to buy in a store face-to-face or online, you start an operation that ends with a charge on your account and a subscription to the store in which you have purchased. Before such a payment is made, it goes through a series of actions that are subject to rules set by the brand of the card used (such as Visa or MasterCard) and subject to a framework of supervision and surveillance of the central banks and competent national authorities to ensure that your money gets where you want it.

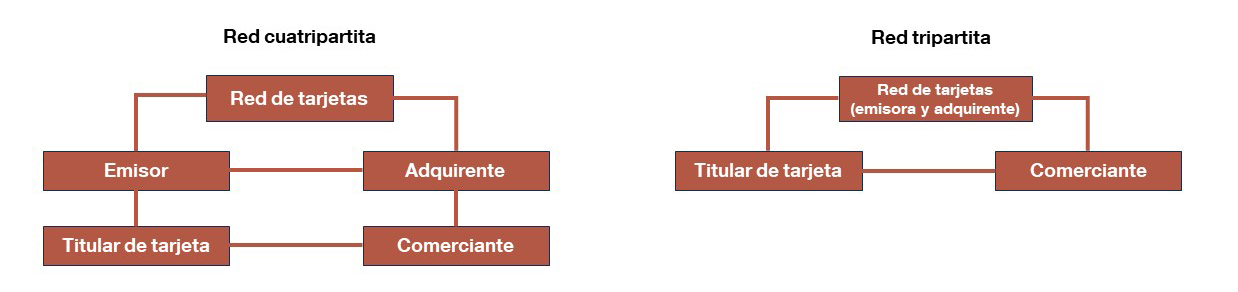

In a card transaction, four parties (four-legged or four-legged model) usually participate: the cardholder, the bank issuing the card, the merchant receiving the payment and the bank providing the service to the merchant so that it can accept card payments. Colloquially the latter is called "acquiring entity" because it offers services necessary for the acceptance or acquisition of card transactions. The brand of the card, in this model, establishes rules that oblige the issuers and acquirers of these cards, but does not act either as an issuer or as an acquirer. Examples of this model would be Visa or MasterCard.

There is another model, in which the card brand is also the issuer and the acquirer (three-legged model or tripartite). An example of this model would be Amex.

What brands of cards are used in Spain?

When you make a purchase, you will see that the merchants show you a series of alternative methods to make the payment (card, Bizum, PayPal, etc.). In the case of cards, the different brands they accept will be visible. Look and you will see brands like Visa, MasterCard, AMEX, Diners, JCB or Union Pay. Each merchant is free to accept the brands they consider, so you will have to check that the brand of your card is one of the options offered. The most frequent are accepted in most shops.

The entities have agreements with these brands to be able to issue and acquire cards from them.

“Disclaimer: Please note that this is a translation of the original in Spanish that has been obtained using eTranslation (the machine translation tool provided by the European Commission), with the intention of giving you a basic idea of the content in English until a human translation becomes available. The Banco de España accepts no liability whatsoever in connection with this translation.”