Saving and dissaving: what habits do Spaniards have?

Saving can be done in many different ways: either by depositing our money in a savings vehicle such as a savings account, a pension plan, an investment fund, shares or fixed income; by purchasing real estate (other than the main residence); or by keeping cash or giving it to relatives so they can save it.

According to the Survey of Financial Competences (SFC)Abre en ventana nueva, performed jointly to a representative sample of adult citizens in Spain (between ages 18 and 79), by Banco de España and the National Securities Market Commission (CNMV), 61% of Spaniards declare they have been saving in the past twelve months using some of the above described methods.

Without excluding any other saving methods, Spaniards have particularly been saving with a current account (63%), while 14% use a savings account and 11% make deposits into a pension plan. Besides, there’s a remarkable share of the population (38%) that save their money outside the financial system, by keeping it “under the mattress”, as in the popular saying.

If we face the opposite decision to saving, the SFC shows that 28% of Spaniards live in a household with dissaving (this is, households where expenditures are greater than the income perceived in the past twelve months). This rate increases among those individuals with a lower educational level (35%) and among those who live in households with an income below 14.500 Euros (44%).

What funding sources did Spanish households in a dissaving situation turn to in order to save the gap between their expenditures and income?

- Half (51%) used their own savings.

- 35% used loans from friends or family, something quite common in those households with very low income.

- 15% delayed their payments or used their credit card resulting in an unauthorised account overdraw.

- 13% increased their existing credit lines (for example, by using their credit card or with a mortgage extension), something more common in those households with a higher income.

- 9% took out new personal loans, both from credit institutions and friends or family.

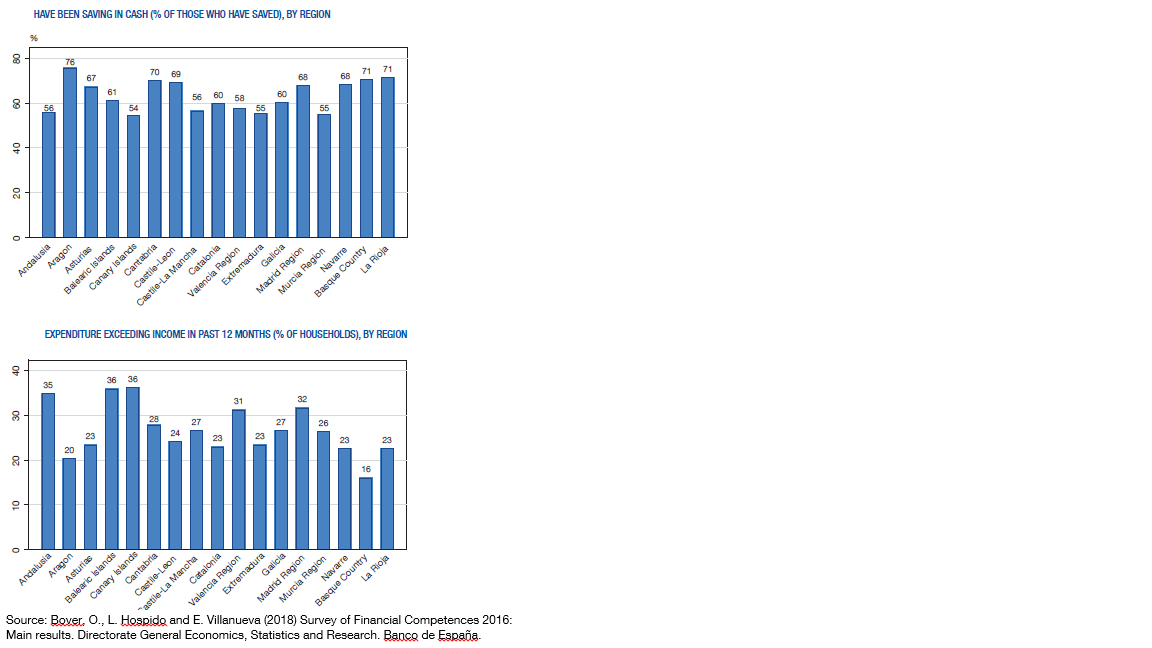

Saving and dissaving decisions also vary depending on regions: Canary Islands, Murcia and Extremadura have proved to be the regions with a lower rate of individuals that have been saving during the past twelve months (around 55%), in contrast to Aragón, Basque Country and La Rioja, where this rate is over 70%. Besides, approximately half of those individuals that have been saving in Andalucía or Balearic Islands keep their money in cash, while this rate doesn’t reach 30% in Aragón, Cataluña, La Rioja or Navarra.

When it comes to dissaving, 35% of the population of Balearic Islands, Canary Islands and Andalucía live in households where expenditures exceed their income, while this rate is 16% in Basque Country or 20% in Aragón. However, in order to interpret these figures correctly, it would be necessary to consider the composition of the population in each region, by educational and income levels.