Does the closure of bank branches and the removal of ATMs pose a risk of exclusion for the population affected?

04/02/2019

In recent years the banking sector has adjusted its business model by closing branches and reducing the number of ATMs, in its search for returns and its adaptation to new technologies.

- From 2008 to 2017, the number of bank branches in Spain (including those of commercial banks, savings banks and credit cooperatives) fell by 39%. Whereas in 2008 branches numbered 45,662 in total, by 2017 there were 27,706, which were similar levels to those recorded in 1981. The change in the number of branches in absolute terms has been most pronounced in Catalonia, Madrid and the Valencia region (with significant rates of decline from 2008 to 2017, of 51%, 42% and 45%, respectively) and in municipalities of more than 10,000 inhabitants.

- Furthermore, as cash dispensers are usually located in branches, branch closures have been accompanied by the removal of many ATMs, although new ATMs have also been installed at locations frequented by large numbers of people, such as shopping centres, airports and train stations (off-site ATMs), which has partially offset this decline. The net result is that between 2008 and 2017 the number of ATMs in Spain has decreased by 17.6%, from 61,714 in 2008 to 50,839 in 2017.

The reduction in the number of branches and ATMs is in contrast to the public’s need to access cash, be it over a bank counter or from a cash dispenser. Cash remains the most usual means of payment in Spain and, consequently, access to cash is of the utmost importance.

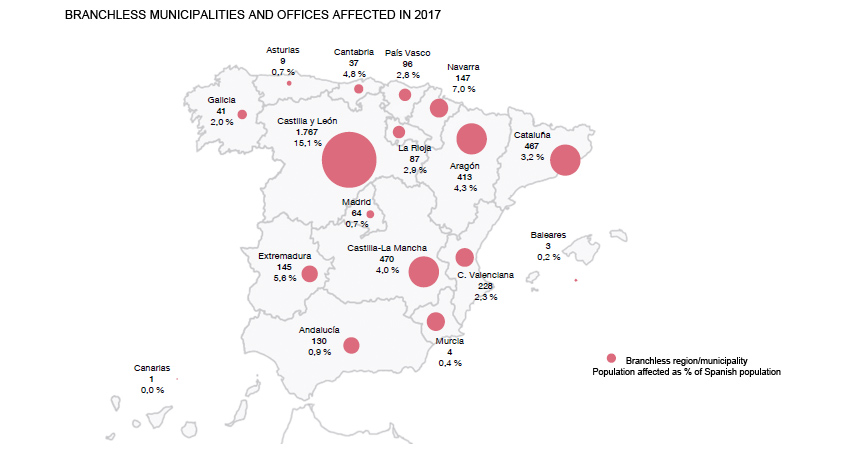

The most critical situation occurs in municipalities which have lost the only bank branch they had: this is the case of 4,109 Spanish municipalities, according to data for 2017 (540 more than in 2008), which means that 1,249,407 inhabitants (2.7% of the Spanish population) do not have this service in the municipality where they live. The regions with the highest number of branchless municipalities are Castile-Leon (1,767), followed by Castile-La Mancha (470), Catalonia (467) and Aragon (413) (see Chart).

Does this pose a risk of financial exclusion for the population affected?

The situation described does not necessarily mean that the population affected is subject to financial exclusion:

- First, because many of the municipalities affected are located close to other municipalities with a bank branch or an ATM. For example, the most highly populated branchless municipality (with 6,872 inhabitants) is three kilometres away from a bank branch.

- In addition, if population density is considered, the vast majority of the Spanish population is concentrated in municipalities where there are more than five bank branches.

- Banks have also developed alternative channels to cover branchless localities, such as mobile banking offices and financial agents which, without a permanent establishment, regularly serve customers in those places where bank branches no longer exist. According to Banco de España data for 2016, in Spain there are at least 690 mobile agencies and approximately 966 municipalities or districts that have their cash service covered through agents, banks’ own employees who are working off-site in these areas or through the services of cash-in-transit companies. Deposit-taking institutions also offer temporary cash services in 609 municipalities or districts and have off-site ATMs in 502 municipalities or districts.

- Lastly, other non-banking agents are starting to offer cash withdrawal services through multi-purpose ATMs or through cashback sevices. Also, the Post Office has reached an agreement with a bank to make its network of 2,400 post offices available to the banks’ customers for cash deposits or withdrawals or to request a door-to-door cash delivery.