At odds with your bank?

04/09/2018

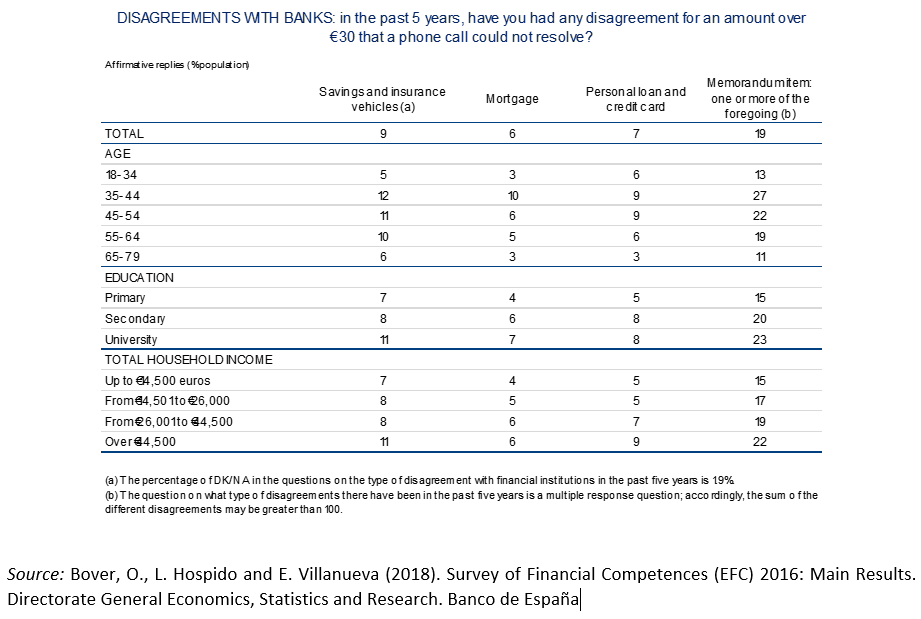

Have you had any disagreement with your bank over the past five years for an amount over €30 that a simple phone call could not resolve?

The recent Survey of Financial CompetencesAbre en ventana nueva (ECF by its Spanish abbreviation) jointly conducted by the Banco de España and the CNMV (Spanish National Securities Market Commission) using a representative sample of adults (aged 18-79) in Spain asked interviewees this question and found that 19% of Spaniards have had some such disagreement with their bank.

Within this group and on a non-exclusive basis:

-

The most common type of problem relates to a saving product of some kind, particularly with interest rates and commissions associated with saving accounts and term deposits. 9% of interviewees have had disagreements over saving products, a percentage representing half of those reporting problems with banks.

-

Mortgages are also a source of discrepancy in approximately 30% of the cases arising (either because of floor clauses, or applications to reduce payments, commissions or interest), as are personal loans or cards.

Another pattern detected by the ECF is that disagreements arising in connection with mortgages or saving products (e.g. with preference shares, deposits, insurance, pension schemes and investment funds) increase commensurately with the interviewee’s educational level, though it should be borne in mind that the holding of any of these products is also more frequent among university-educated individuals.

This finding leads to the question of whether individuals with a higher level of financial literacy are those who are more likely to have disagreements with banks. A more in-depth analysis of the data should offer a reply to this interesting question.