What do we Spaniards know about the compound interest rate?

According to the results of the Survey of Financial CompetencesAbre en ventana nueva, performed jointly to a representative sample of adult citizens in Spain (between ages 18 and 79), by Banco de España and the National Securities Market Commission (CNMV), this concept is unknown to more than half of the Spaniards that were interviewed.

One of the Survey’s questions was: which would be the profit obtained after a 5 year deposit of 100 Euros in a savings account with a 2% fixed annual interest rate, in which the obtained interest is paid and no other deposits or withdrawals are made. Interviewees had to choose from 4 possible answers: more than 110 Euros, 110 Euros exactly, less than 110 Euros, or the result cannot be worked out with the given information. The results show that 46% answered the question correctly (“more than 110 Euros”), 44% answered incorrectly, and 10% said they did not know the answer to the question.

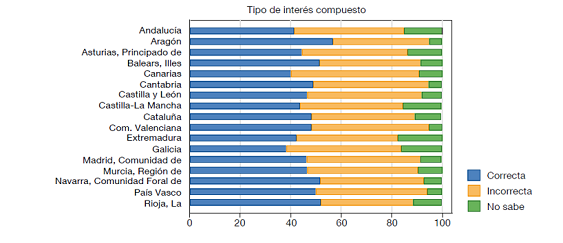

By autonomous regions, Aragón, Navarra and La Rioja stand out with a higher hit rate (57% for the first one and 52% for the other two), while Galicia, Canary Islands and Extremadura show lower rates (between 38% and 42%).

By gender, correct answers given by women is 8% lower than the rate of correct answers given by men (50% of men answer correctly versus 42% of women).

By the interviewee’s household income: 58 % of households with an income over 44.500 Euros have responded correctly versus 39% of those with an income up to 14.500 Euros.

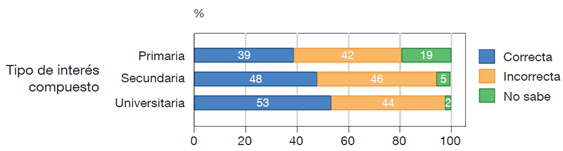

By educational level: 53% of interviewees with university education responded correctly versus 39% of those with primary schooling.

The rate of correct answers also varies within different age groups: 46% for those interviewees under 35 and between 55 and 64; 50% for those between 35 and 44, and 35% for those over 65.

Remember that the money saved in your account for several years will evolve depending on the annual interest rate applied to the amount saved during the first year, and also on the interest accumulated from that moment –given that no fees or taxes are charged on the account and that no deposits or withdrawals are made-. If we don’t consider that the interest also applies to interests already accumulated, we will be underestimating the returns on our savings and, by that same logic, the cost of the debt. In short, this would be the concept of compound interest rateAbre en ventana nueva.

Answers to the question about compound interest rate by educational level.

Answers to the question about compound interest rate by age groups.

Answers to the question about compound interest rate by Autonomous Regions (%)

Source: Bover, O., L. Hospido and E. Villanueva (2018) Survey of Financial Competences 2016: Main results. Directorate General Economics, Statistics and Research. Banco de España.