COMPLAINTS filed up to 30 September 2018

05/10/2018

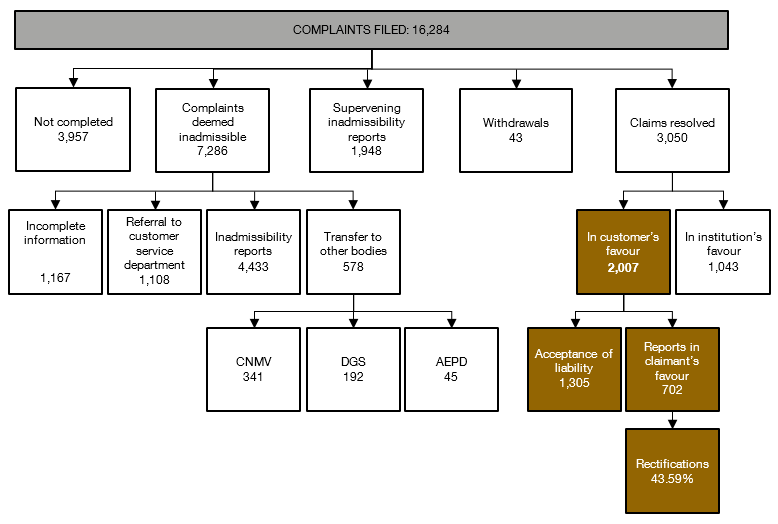

In the first three quarters of 2018 the Market Conduct and Claims Department (DCMR) received 16,284 complaints.

-

In 3,050 instances, the documentation submitted by the complainant was complete and sufficient for the complaint to be processed. The DCMR therefore forwarded the complaint to the institution concerned for it to respond accordingly. The outcome was as follows:

- In 2007 cases the matter was decided in the complainant’s favour. Of these, in 1,305 instances, the institution agreed that the customer was right, accepting their claim, such that the DCMR did not have to issue a report, as the claimant’s complaint had been upheld and their claim satisfied (acceptance of liability). In 702 cases a report in the complainant’s favour was issued, i.e. the DCMR considered the institution to have acted inappropriately, in whole or in part. To date, the institutions concerned have rectified their conduct in 43.59% of these cases (306 instances). In view of the fact that institutions have one month in which to rectify their conduct, a significant number of cases (702) are still pending rectification

- 1,043 reports found in the institution’s favour, i.e. the DCMR considered the institution to have acted correctly.

-

In 43 cases the complainant expressly stated that they did not want to continue with the complaint (withdrawal).

-

9,234 of the complaints filed were declared inadmissible by the DCMR, in accordance with the applicable legislation, and the interested party was informed of the decision. The reasons for inadmissibility were:

a) In 1,167 instances, the interested party was asked to submit certain necessary documentation, and to date has not done so (incomplete information). For example, complainants might be asked to submit a copy of the documentation from the bank reflecting the facts underlying the customer’s disagreement (if the complaint related to the charging of a fee, a copy of the statement showing the fee would be requested), specifying the object of the complaint or identifying the institution against which the complaint is being made.

b) In 1,108 cases no evidence was submitted to show that the complaint had first been filed with the institution concerned (and decided against the customer), or if it had been submitted, the legally stipulated period for the institution to reply had not yet expired (referral to Customer Service Department).

Note that in these 2,275 cases, if the interested party eventually sends the requested documentation to the DCMR the case will be reopened and forwarded to the institution concerned.

c) In 578 instances the case was transferred to the body responsible for its consideration and resolution (in 341 cases to the National Securities Market Commission (CNMV), in 192 cases to the Directorate General of Insurance and Pension Funds (DGS) and in 45 cases to the Spanish Data Protection Agency (AEPD)).

d) The complaint is covered by one of the exclusions of competence or inadmissibility under the current legislation, whether at the time of filing (4,433 cases, in which the DCMR has issued inadmissibility reports, for example complaints filed against entities not supervised by the Banco de España, matters that are sub judice, commercial policy, etc.) or subsequently (1,948 cases in which the DCMR issued supervening inadmissibility reports, for example, because the institution concerned submitted evidence that the dispute is being considered by the courts).

-

The remaining 3,957 complaints are currently being processed (either awaiting documentation requested from the complainant or the institution, or pending resolution).