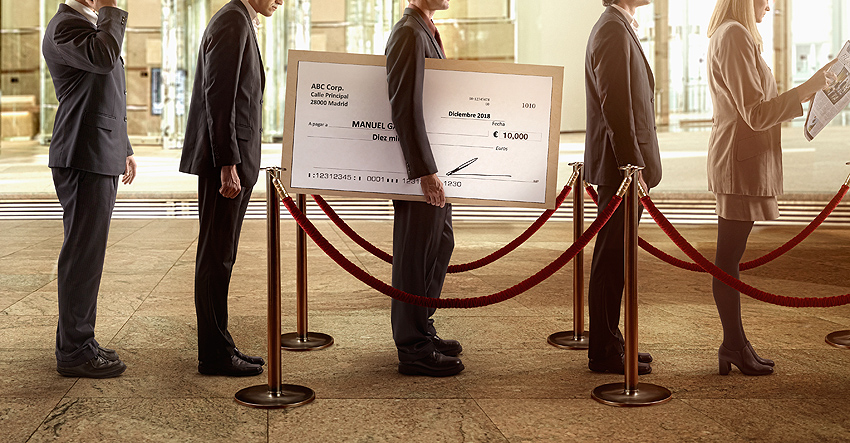

How to cash a cheque

12/08/2019

A cheque is a document used as a method of payment whereby one party (the drawer) instructs a bank (the drawee) to pay a specific amount of money to another person or firm (the payee). The drawer and the payee may be the same person, for example when you use a cheque to withdraw money from your own account.

A cheque must be paid in the place stated on the cheque next to the name of the drawee. If you wish to cash a cheque, you must bear in mind the following:

- If the words “to be paid into account” are written on the front of the cheque (whether it is a bearer cheque or a cheque to a named payee), the payee will have to pay it into an account as it cannot be cashed directly.

- If the cheque is crossed (if it has two parallel lines across the front) and the payee is not a customer of the drawee bank, it will also have to be paid into a bank account.

- Only the branch indicated on the cheque is obliged by law to cash it. In consequence, the bank may refuse to pay the cheque at a branch that is not the drawee branch, irrespective of the amount of the cheque, unless the bank is obliged, by contract, to pay it at any branch.

- If a bank pays a cheque over the counter at a branch other than that where the drawer’s account is held it runs a risk, as it is unable to check that the drawer’s signature coincides with the account holder’s signature. This security measure is necessary in order to prevent fraudulent cheques being paid, or cheques being paid to the wrong payee.

- However, thanks to new technologies, a different branch will usually pay a cheque. In this case the branch will have to obtain the necessary confirmation from the drawee branch (balance available, verification of signature, etc.), which may result in additional expenses (charges) for the customer.

- And remember, you must always present identification if you wish to cash a cheque for €1,000 or more (or even for a lower amount, if the bank considers there are signs of money laundering).