Digital euro: What will make it unique compared to other means of payment and assets?

24/04/2025

Surely you have heard of the digital euro, but do you know that it will differentiate it from other means of payment or other types of assets (such as crypto-assets)?

The Eurosystem continues to work on the digital euro projectAbre en ventana nueva to deliver a modern version of cash that is better suited to the needs of an increasingly digitalised society.

The digital euro will be an additional means of payment, coexist with the banknotes and coins we know today and its use will be voluntary for consumers. It will make it possible to make daily payments safely and efficiently, both in physical stores and online, and will be available to all citizens of the euro area. In addition, it will guarantee the privacy of users and allow to pay there is, or not, Internet connection.

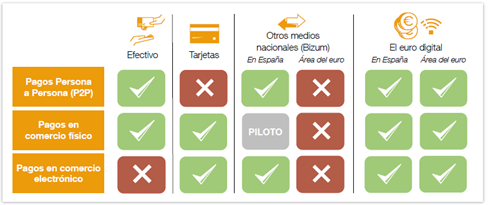

As can be seen in the following table, with the digital euro we can make all our day-to-day payments: between people, in physical stores and in e-commerce. In addition, it will allow you to pay both in Spain and in any country of the euro zone, offering a safe, efficient and complementary alternative to the current means of payment.

Source: Statement by the Governor at the Fifth Financial Observatory. "Building the digital euro"

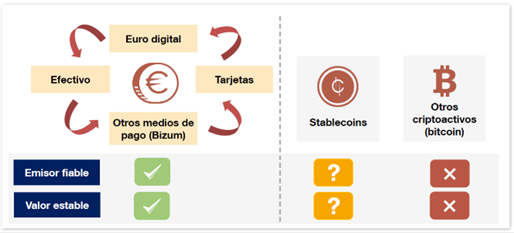

Importantly, the digital euro is not a crypto-asset. Its value will always be equivalent to that of cash and will be backed by the European Central Bank, which will ensure its reliability. That is, like, for example, cards and Bizum, issued by banks supervised by the Eurosystem, the digital euro will have a reliable (public) issuer and a stable value.

Conversely, issuer reliability and value stability are not always clearly guaranteed even for stablecoins (marked with question marks) n for other crypto-assets (marked with a red X):

Source: Statement by the Governor at the Fifth Financial Observatory. "Building the digital euro"

As we have mentioned before, less and less cash payments are made and more with cards and mobile applications. In fact, 72% of card payments are made through international brands, and many mobile apps like Google Pay and Apple Pay are not European. In this sense, the digital euro offers an opportunity to strengthen the single euro payments area and reduce our dependence on foreign suppliers in a crucial sector for our economy.

In short, the digital euro represents not only an evolution in the way we make retail payments, but also an opportunity to strengthen the economic independence of the euro area. By offering a safe, efficient and European Central Bank-backed alternative, the digital euro is positioned as a fundamental pillar in modernising our financial system, ensuring the privacy and stability citizens need in an increasingly digitalised world.

“Disclaimer: Please note that this is a translation of the original in Spanish that has been obtained using eTranslation (the machine translation tool provided by the European Commission), with the intention of giving you a basic idea of the content in English until a human translation becomes available. The Banco de España accepts no liability whatsoever in connection with this translation.”