Do you want to know the recent evolution of fixed-rate mortgages?

05/05/2022

Do you want to know what the trend has been in interest rates on fixed-rate mortgage loans over the last three years?

Every quarter and on a case-by-case basis, banks send information to the Banco de España on the interest rates and fees usually applied to certain banking products.

In the case of fixed-rate mortgages, the information reported by institutions is the modal annual interest rate (the rate most frequently applied), the modal opening fee and the APR resulting from this data. This information is not an offer and does not commit the institution, but it allows you to know what interest rate your institution has applied and to compare it with any other institution in the sector.

The information is public and it is available for consultation in our comparison tool.

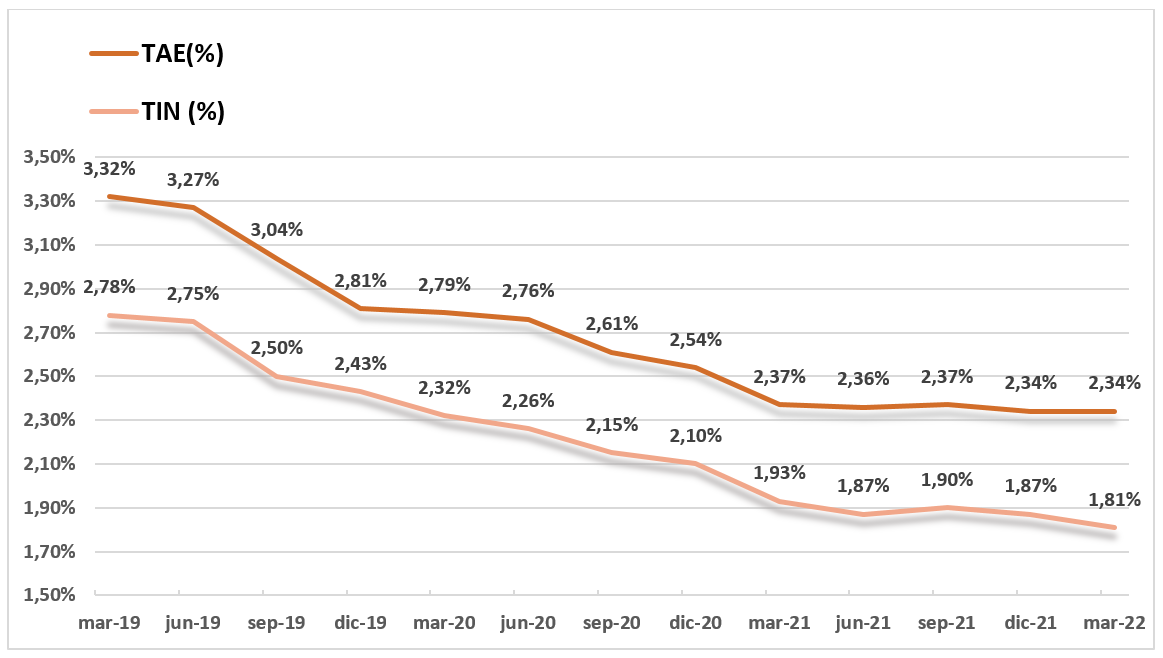

Here we show the quarterly evolution of the average data, both of the nominal annual interest rate applied and the APR of all institutions for fixed-rate mortgage loans.

You can see that after the downward trend in 2019 and 2020, there is some stabilisation of rates in 2021 and the beginning of 2022.

Préstamos hipotecarios a tipo fijo para adquisición de vivienda habitual

Download (11 KB) the Excel data.