What do complaints say about banks’ customer service departments (CSDs)?

26/11/2018

One of the functions of the Market Conduct and Claims Department (MCCD) is to supervise and oversee banks’ conduct and the functioning of their customer service departments (CSDs). Through the processing of the complaints, the MCCD obtains indicators of banks’ behaviour when they have to resolve conflicts with those customers who consider that their rights have been infringed. There are three basic indicators which assess how CSDs function:

-

Acceptance of liability. This happens when banks uphold their customers’ claims, but only once the latter have filed their complaint with the Banco de España. If the percentage is very high, their behaviour is considered to be unsatisfactory since, if they acknowledge that the customer is right, they should accept liability when the complaint is filed with their CSD.

-

Reports in the complainant’s favour. Banks must be well versed in transparency regulations and best banking practices, so that the percentage of reports issued by the MCCD which are critical of their conduct should be as low as possible.

-

Rectifications. Although the MCCD’s report is not binding, opinions favourable to the complainant should be rectified by the banks in a high percentage of cases, especially where regulations have been breached.

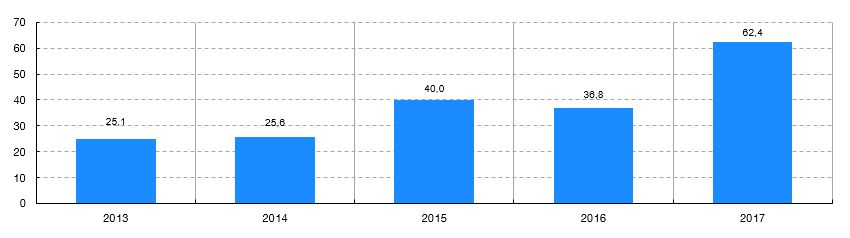

PERCENTAGE OF RECTIFICATIONS IN THE LAST FIVE YEARS

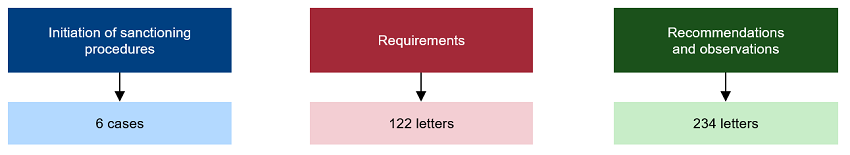

Note that where the MCCD detects breaches of transparency regulations or repetitive non-compliance with best banking practices, it may commence disciplinary action. During 2017 the MCCD implemented the following supervisory measures:

The matters which gave rise to this action are as follows: