Claims submitted in 2017

13/07/2018

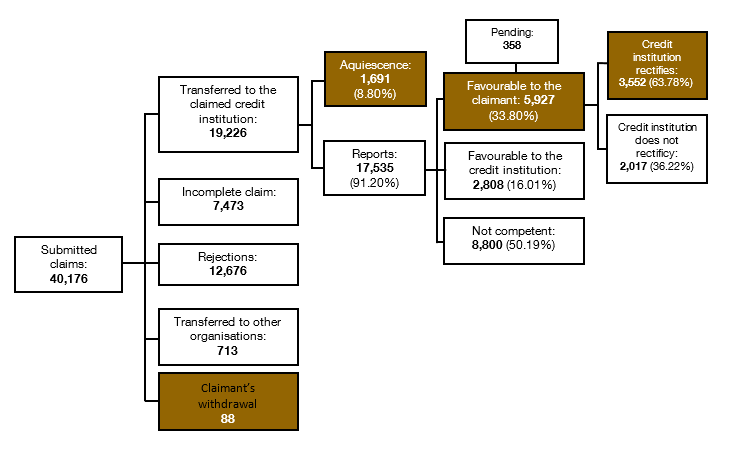

The Market Conduct and Claims Department (DCMR) received 40,176 claims during 2017:

- In most cases (19,226), the documents provided by the claimants were correct and enough to be able to continue with the claim procedure, so the DCMR transferred them to the claimed credit institutions to receive their arguments.

- There were 7,473 requests for certain necessary documents sent to claimants, who have not answered so far. As an example: requests for documentary evidence of having sent the claim to credit institution beforehand, or copy of banking documents proving the claimed issues (if disagreement was regarding a charged fee, the bank statement showing such fee was requested).

- The DCMR rejected 12,676 submitted claims, in accordance with applicable regulations, and informing the claimant consequently (for example, claims against credit institutions that are not supervised by Banco de España, or regarding issues which are legally competence of the courts).

- 713 files were transferred to the corresponding competent organisation (Spanish Data Protection Agency, National Securities Market Commission or Directorate General for Insurance and Pension Funds).

- There have been 88 cases where the claimant has voluntarily refused to continue with the claim procedure (withdrawal).

If we focus on the 19,226 claims where the credit institution’s arguments have been requested, the results are the following:

- There have been 1,691 cases where the credit institution stated that the customer was right (acquiescence) and therefore agreed to his/her request (which would be a 8.80%), and as a result, the DCMR did not have to issue the corresponding report.

- In the remaining cases, the DCMR has issued the following reports:

a) 5,927 favourable reports to claimants (with a total of 17,535 issued reports, the resulting rate would be 33.80%), which means that the DCMR has considered that the credit institution’s conduct was totally or partially incorrect:

- 358 claims are still pending, as the credit institution has one month to communicate to the DCMR whether it rectifies or not.

- In the remaining 5,569 claims in which the deadline within the credit

institution must communicate the DCMR its decision has passed, it has finally rectified in 64% of these cases (3,552)

b) 2,808 favourable reports to credit institutions (16.35% of the total reports issued), which means that the DCMR considered that the credit institution had acted correctly.

c) In the remaining 8,800 reports, (51.23% of the total reports issued), the DCMR could not state whether the credit institution had acted according to transparency regulations or best banking practices once its conduct had been analysed. In 2017, most of these cases were claims that had to do with “arrangement expenses”: claims submitted as a result of a judgement of the Supreme Court at the end of 2015, where consumers disagree with having paid all the arrangement expenses of their mortgages and therefore request a reimbursement. In these cases, the DCMR has demanded that credit institutions thoroughly analyse the claims received, giving a reasoned reply through their Customer Care Service according to the above mentioned judgement and detailing the measures that have been taken. Even though the credit institutions perform the mentioned analysis, the DCMR isn’t in a position to determine the amounts that should or should not be reimbursed to their customers. The lack of a reasoned reply would result in a negative report towards the credit institution’s conduct.

Check more statistics