The financial inclusion of immigrants in Spain

09/10/2018

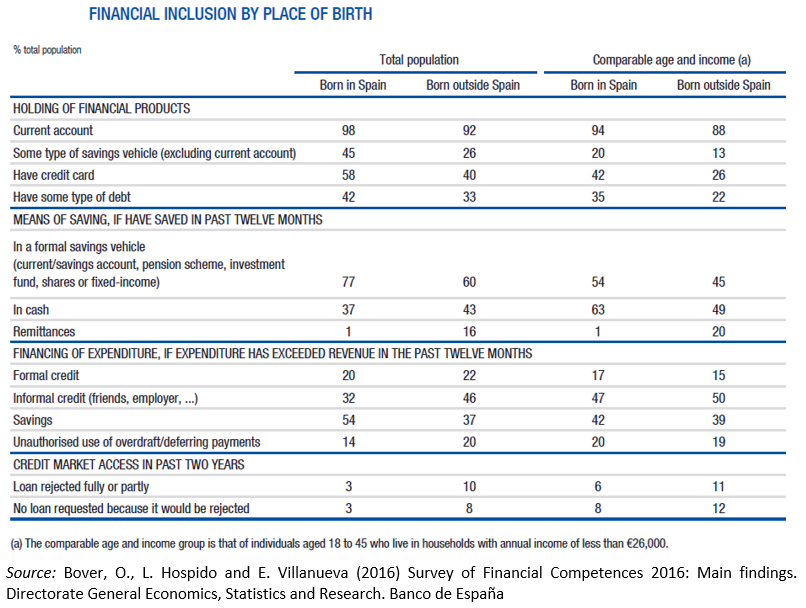

A basic measure of financial inclusion is the holding of a current account as an instrument for managing income and payments. In other European countries, for both economic and cultural reasons, the holding of financial products varies by country of birth and these differences persist even when comparing nationals and immigrants of a similar age and income. Is it the same in Spain?

The recent Survey of Financial CompetencesAbre en ventana nueva, conducted jointly by the Banco de España and the Spanish National Securities Market Commission (CNMV) in Spain among a representative sample of adults (aged between 18 and 79), finds that 8% of immigrants say that they do not have a current account, compared with 2% of those born in Spain.

The Survey of Financial Competences also finds that there are differences in the holding of savings vehicles, debt and means of payment, with lower levels among those born abroad. For instance:

-

Whereas almost half of those born in Spain have some type of savings vehicle, only 26% of immigrants have them.

-

42% of those born in Spain have some kind of debt (mortgage or unsecured loan) compared with 33% of immigrants.

-

While 58% of those born in Spain have a credit card, only 40% of immigrants have one.

Although those born outside Spain represent a very diverse group, overall, they are younger and live in lower-income households than those born in Spain. Consequently, it is useful to compare them with nationals of similar characteristics. The difference in terms of “holding a savings vehicle” drops considerably (from 19 pp to 7 pp), if we compare the data for nationals and foreigners of similar ages and income levels (specifically for the 18-45 age group living in households with income of less than €26,000), although as regards “holding a current account, debt or means of payment”, the differences remain at similar levels.